Air Hong Kong is a fully owned subsidiary of the Cathay Group, and its fleet’s yellow tails and branding reflects its primary customer, DHL Express. Air Hong Kong provides crew, maintenance and insurance for this fleet carrying express parcels to and from DHL Express’ newly expanded hub facility at Hong Kong International Airport via a big regional Asian network. Cathay Cargo then acts as a ground handling agent for the operation and a general sales agent for any remaining capacity. Clarence Tai has been Air Hong Kong’s Chief Operating Officer since September 2020, and Cargo Clan caught up with him in Cathay House, close to Hong Kong International Airport (HKIA), where he manages his team of about 50.

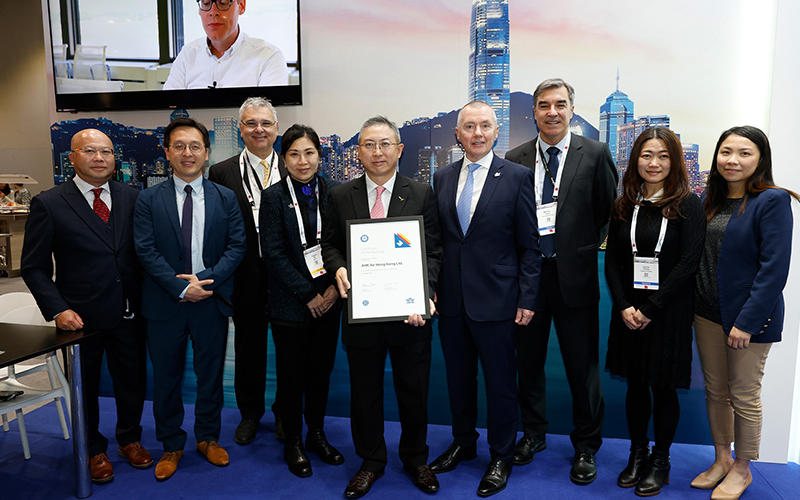

You collected your IATA membership at the World Cargo Symposium. How was that?

I got the certificate directly from Willie Walsh, IATA’s Director-General, at the World Cargo Symposium, and he was very happy because we were the first new member for 2024. Although the event was in March, we’d been a member since January, having applied in December.

Why did Air Hong Kong decide to join IATA?

After the pandemic, we were able to take more of a long-term view of what’s best for Air Hong Kong, and we came to the conclusion that maybe this is the right time. We were already meeting requirements anyway, such as the IOSA [IATA Operational Safety Audit]. So there was nothing additional we had to do except pay the membership fee!

Being an IATA member passes on some savings for IOSA, but the other big benefit is that we have access to a lot of industry partners’ information in terms of safety and operations, and that helps us maintain our own standards. IATA is very well known worldwide, so we can tap into that brand exposure. It’s easier for us to reach out to potential customers who understand the global standards we operate to.

How many aircraft do you have now, and how is the fleet conversion programme going?

Today we have 16, but our requirements are actually for 15. We have been gradually replacing the older Airbus A300Fs with new A330-P2F (passenger-to-freighter) conversions. At this point of time, we’ve received a new A330, but we haven’t released the old A300 yet, so we are in a transition and have an extra aircraft. Two of our ten A330 aircraft are production freighters, with eight P2F conversions. We still have six A300s, but one will be leaving soon once we have processed the latest transition. By Q2 next year we will have completed our entire aircraft rollover programme. Each A330 offers around 20-30 per cent additional payload, but that’s dependent on route and range.

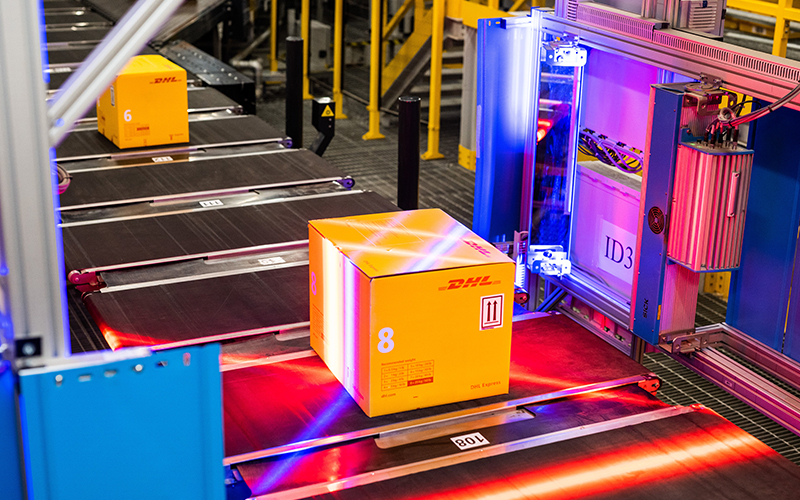

Your principal customer DHL Express recently extended its facility at Hong Kong. How does that affect you?

The facility increases their overall capacity by 50 per cent or so and I think it is a huge vote of confidence for Hong Kong and its air-cargo industry. In terms of DHL’s intra-Asian regional operations, we account for a significant share of their entire operation and, with the extended facility, we are confident that our share will continue to grow with their future business development plans. Hong Kong is the one of the three principal global hubs for DHL Express along with Leipzig in Germany and Cincinnati in the US. Most of the intra-Asian flights go through the Hong Kong Hub. With so much demand for capacity during the pandemic, we increased our weekly frequencies from 63 to 80 or even more. This just showed how flexible we are operationally. Now we are averaging 75, which reflects market demand.

And so that gives you scope for growth…

With our A330 fleet we are now EDTO-compliant [extended diversion time operations], so we can fly to longer range destinations – and over water. We started flying to Bahrain during the pandemic which opened up opportunities – a few months ago, we operated a flight into Leipzig as we returned one of our A300 aircraft back to Europe. In the coming months, as we continue to return the remaining A300 lease aircraft back to Europe, we are likely to operate to more new destinations. But otherwise, the focus right now is on our aircraft programme, and becoming a single type operator.

Are aviation supply chain and resourcing issues affecting your business?

The A300 aircraft is an older type, developed in the 1970s/1980s, so we’ve known about any issues for a long time and we know what particular components are critical – you can pre-order those even as they get harder to get hold of. That situation hasn’t really changed. But at the moment, everyone is seeing a general supply chain issue that is even affecting younger aircraft such as the A330s.

Where do you maintain your aircraft?

In terms of base maintenance rather than line checks, this work is carried out for us by Starco (Shanghai Technologies Aerospace) in Shanghai for the A300s, while Haeco does the work for our A330s in Hong Kong.

Cathay Cargo is your GSA for available capacity. What’s the level of business now?

We have seen year on year improvements from Cathay Cargo selling our available space. And I am very pleased and impressed with their work, but of course in a business, you want to do even more. We’re on a mission to keep improving and to keep utilising all available space. The market is driving this as well because it is craving space on the Cathay Pacific flights and we offer alternative capacity and it’s in the same selling system.

How does this work in operational terms?

It’s more complicated than the Cathay model, which is purely Cathay Pacific aircraft using the Cathay Cargo Terminal. We get most of our shipments from the DHL Express Terminal (DHL Central Asia Hub). Additionally we get shipments from the Cathay Cargo Terminal and other terminals, plus transhipments from other carriers at Hong Kong International Airport. The process involves a lot of coordination and support on the ground from DHL Express, Cathay Cargo, Cathay Cargo Terminal and the other terminals and suppliers, so it’s a bit complex. I sometimes say I would like our operations to be a bit more ‘boring’ and straightforward, but it’s an exciting business and we can only try to serve our customers even better by becoming the best express cargo carrier, first in Asia, then in the world. Although it’s an evolving world, that’s our vision.

Air Hong Kong in numbers

| Established: | 1986 / commenced operation in 1988 |

| Fleet (as of May 2025): | 16 (10xA330F/P2F; 6xA300F) |

| Single fleet by: | 2025 |

| Scheduled destinations: | 14 |

| Became IATA member: | January 2024 |

| Weekly frequencies: | 75 on average |

The voice of the customer: DHL Express

How important is Hong Kong to your current and future operations?

Hong Kong is an important market to us. We have been present here for more than five decades and have witnessed its fast development and progress over the years. Hong Kong has remained significant, given its strategic location in the heart of Asia and close proximity to the Chinese Mainland – the world’s second largest economy. With its robust connectivity and infrastructure, Hong Kong will continue to serve as a centre of DHL’s Asian logistics network. This is why we established one of our three global hubs, the Central Asia Hub in Hong Kong. Since the opening of the expanded Central Asia Hub, which is capable of handling up to 125,000 shipments per hour, the Hub has maintained its role as a unique gateway for intercontinental trade between Asia and the rest of the world.

Teresa Kwan, Vice President Aviation APEC, DHL Express

How is AHK performing and how important is the relationship?

As the dedicated and purpose-built air express cargo facility in the Hong Kong International Airport, the DHL Central Asia Hub is bolstered by key partner airlines, including Air Hong Kong. Air Hong Kong has been a vital carrier, as it works with us to support intra-Asia trade and e-commerce growth. Modernising Air Hong Kong’s fleet is necessary to further boost its agility to support the future growth of Asia Pacific, as well as provide reliable operations key to DHL Express’s customer promise. We look forward to strengthening our partnership in the coming years.

Mr Michael Edmunds, Vice President Aviation Network Planning & Control APEC, DHL Express